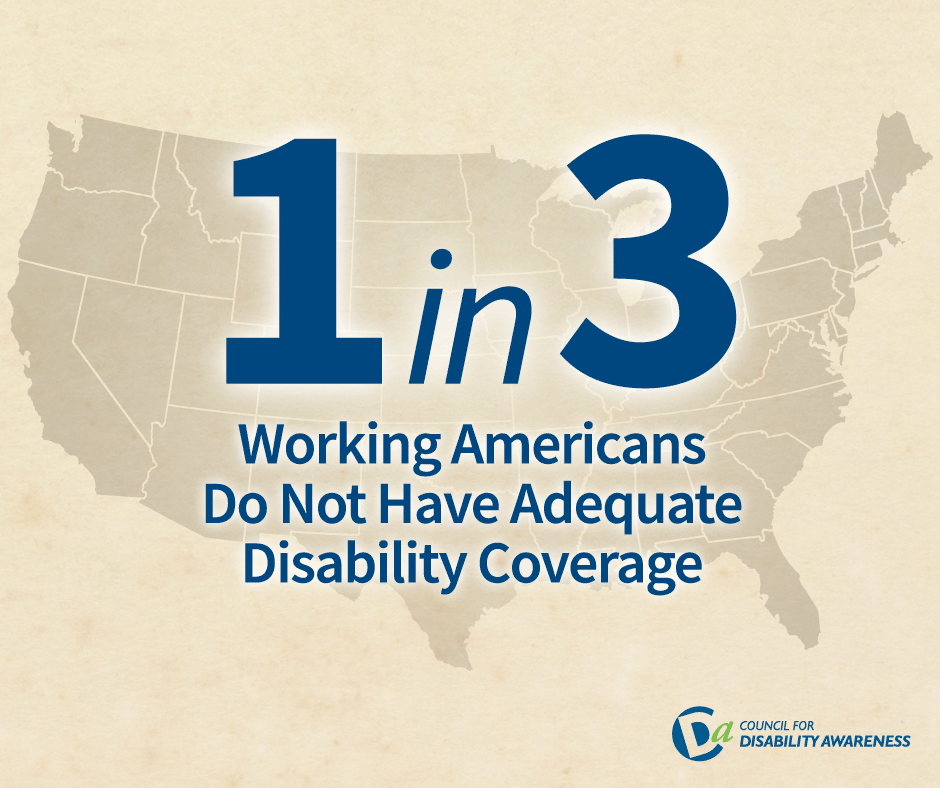

Many employers offer group short—and long-term disability coverage as part of their employee benefits package. However, smaller firms, particularly those in blue-collar industries, are less likely to offer comprehensive disability coverage.

These companies may often only provide group short-term disability, which typically pays benefits for 3 to 6 months. Even organizations historically offering group disability plans are reassessing their benefit structures due to rising costs associated with group health insurance. This has led to an increase in the variety and availability of voluntary insurance plans.

What Are Voluntary Benefits?

Voluntary benefits are insurance policies or products offered by your employer that employees can choose to purchase. These programs are beneficial because they enable employers to provide appealing benefits without facing extra costs. Key features of voluntary benefits include:

- 100% Employee-Paid: Premiums are deducted from your paycheck.

- Employer-Sponsored: These plans come with administrative support from your employer.

- Convenient Enrollment: Enrollment is conducted on company time, often with little or no medical underwriting.

Common Voluntary Disability Benefits

Here are some common voluntary disability benefits available through payroll deduction:

- Disability Income Insurance: Provides a portion of your pre-disability earnings if you become disabled due to an accident or illness.

- Cancer Insurance: Pays a flat dollar amount upon a cancer diagnosis.

- Accident Insurance: Offers benefits tied to specific named injuries.

- Accidental Death and Dismemberment (AD&D) Insurance: Pays cash benefits in the event of accidental death or loss of a limb.

- Long-Term Care Insurance: Helps cover costs associated with care at home or in a long-term health facility.

Each of these products offers vital financial support during major medical events. They are intended to function together, strengthening your overall insurance portfolio and enhancing your work-life balance.

Advantages of Voluntary Benefits

Voluntary benefits are becoming a crucial part of many companies’ overall benefits strategies. Here are some advantages to take into account:

- Diverse Product Offerings: Access a wide array of products tailored to your needs.

- Simplified Underwriting: Many plans offer guaranteed issue for initial enrollees.

- Discounted Premiums: Benefit from group discounts that lower your costs.

- Portability: Keep your coverage even if you change jobs.

- Easy Enrollment: Enjoy a straightforward enrollment process at your workplace.

- Convenience: Payroll deduction makes it easier to manage payments with no medical exams required.

Conclusion

Voluntary benefits can effectively fill significant gaps in your insurance coverage, making it easier to manage financial challenges that arise from disability and income loss. By offering these plans, your employer recognizes the need for more comprehensive benefits and provides a way for you to improve your financial security. Take the time to explore your options, evaluate the benefits, and make an informed decision that best fits your needs.